Consumers started by Renting the Runway. Now Nuuly is taking center stage.

by Jewel Chen - 15 Mar 2024

In 2009, Rent the Runway pioneered a new approach to consumers’ wardrobes - one-time formal attire rentals via a sleek, easy-to-use online platform. The service gained popularity with women dressing for occasions from proms to board meetings. In 2016, Rent the Runway was amongst the first to introduce a clothing subscription service, renting clothes for the office and special events at a fraction of the items’ original retail prices.

Since then, the clothing subscription landscape has changed significantly. Armoire was founded in 2016, FashionPass in 2017, and URBN-backed Nuuly in 2019. Each introduced its own twist on the service model and brought different types of inventory into circulation. A myriad of subscription services from entertainment to wellness have entered the general fray as well and are all vying for a share of the consumer’s wallet. Consumers’ preferences have also shifted significantly since the mid-2010's, in no small part due to COVID and its aftereffects on society as a whole.

The renewed focus on profitability underscores the importance of adapting to these preferences in order to continuously delight consumers. Nuuly’s success1 - driven in part by steady sales growth and high customer retention rates - serves as both proof and pressure for its peers. The question now is whether Rent the Runway can increase its stage presence by successfully forging their own path to profitability in 2024.

The Backdrop

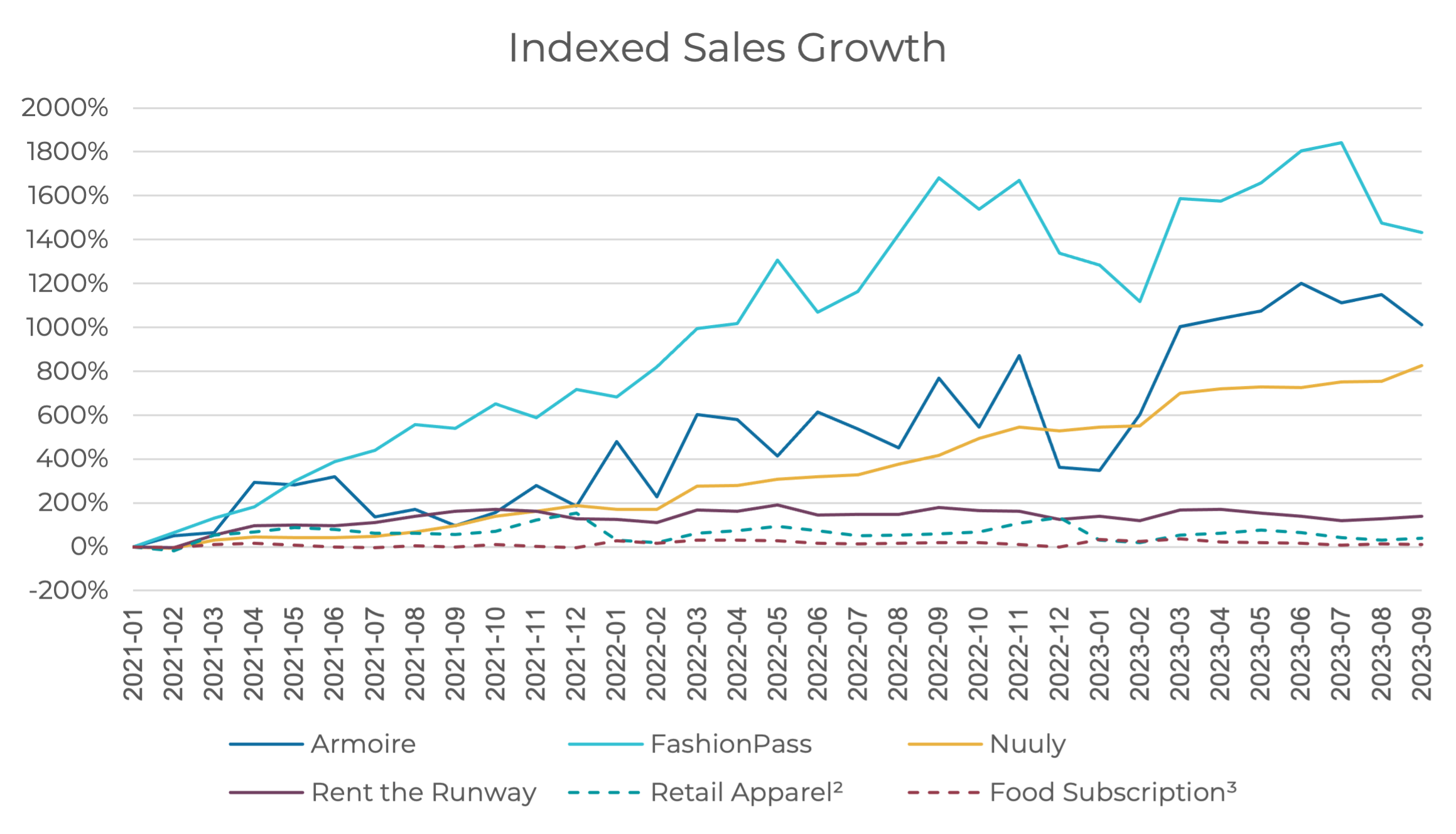

Across both apparel and subscription industries, clothing subscription remains an area of high growth. Since January 2021, sales growth rates for Armoire, FashionPass, Nuuly, and Rent the Runway have all exceeded those of companies in the retail apparel space. Clothing subscription growth rates are also higher than their counterparts in the food subscription vertical, another popularized service.

However, market share between the clothing subscription services has shifted dramatically over the last 2.5 years. Rent the Runway’s market share decreased from 68% in January 2021 to 35% in October 2023. During the same period, Armoire, FashionPass, and Nuuly have doubled or tripled their market shares.

Spotlighting Nuuly's Success

Nuuly’s market dominance is particularly impressive - and demonstrates the flywheel dynamic that delighting customers has on acquisition, retention, and lifetime value.

On average, Nuuly’s retention rate is 2.4x higher than those of peers and, more importantly, translates directly to high lifetime value. As a recent Wall Street Journal article observed4, clothing subscription services are by no means cheap. At the start of 2022, all four clothing subscriptions offered similar initial pricing. However, Rent the Runway’s mean starting price of $98.96 is the highest on the market and is designed to increase significantly in subsequent months depending on the subscription plan. Nuuly’s $91.25 mean initial purchase price represents on average a 7% discount to their flat stated price of $98 / month. Once onboarded, Nuuly’s customers demonstrate a greater willingness to continue paying full price for the service, decreasing the need for discounts designed to reactivate dormant users

Nuuly couples efficient user monetization with effective user acquisition. Over the last 6 months, 9% of Nuuly’s acquired customers previously shopped at Rent the Runway. 3% were previously FashionPass customers. While the majority of growth at clothing subscriptions services is driven by new-to-vertical customers, Nuuly’s ability to pull users from its competitors is certainly noteworthy.

A Turning Point

With retention rates closer to Hulu and Netflix levels than their clothing subscription peers, it is clear that Nuuly’s product offering and pricing not only entices consumers but also maintains resonance month after month.

In a bid to distinguish its services and attract a new set of customers, Armoire has leaned into professional women and embraced the return to in-person if not office. They have partnered with Deloitte to extend employee offers via the Perks at Work platform5 and have been hosting events centered around tech, young professionals, and entrepreneurship. Armoire’s success with these endeavors is reflected in their customer base’s income composition - the highest of all four services.

Rent the Runway must also find its place within the broader apparel landscape. If COVID served as a chaotic intermission, then the post-COVID years call for invigorating second act - one which has begun with the hiring of Natalie McGrath as CMO6. Whatever comes next must translate into sustained increases in customer lifetime value in order for Rent the Runway to present a satisfying denouement.

Footnotes:

- 1. CNBC: Clothing rental service Nuuly reaches profitability, beating rival Rent the Runway to the benchmark

- 2. Retail Apparel consists of Aritzia, Club Monaco, Coach, Eileen Fisher, Everlane, J.Crew, Kate Spade, Madewell, M.M.LaFleur, Reformation, Theory, Tory Burch, and Zara.

- 3. Food Subscription consists of ButcherBox, EveryPlate, Factor, HelloFresh, HomeChef, Hungryroot, and Tovala.

- 4. The Wall Street Journal: Renting Clothes Was Supposed to Be the Future of Fashion. Then Shoppers Got Bored.a>

- 5. Armoire COO and CMO Sanober Mukadam

- 6. The Wall Street Journal: Rent the Runway’s Plan for Regrowth Starts With a New Marketing Chief

Request a Demo

Discover what transaction data can do for your business.

Location:

530 Barron Street, Menlo Park, CA 94025

Email:

inquiry@indagari.com

Call:

+1 408 384 9732